Life Insurance in and around Grandville

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

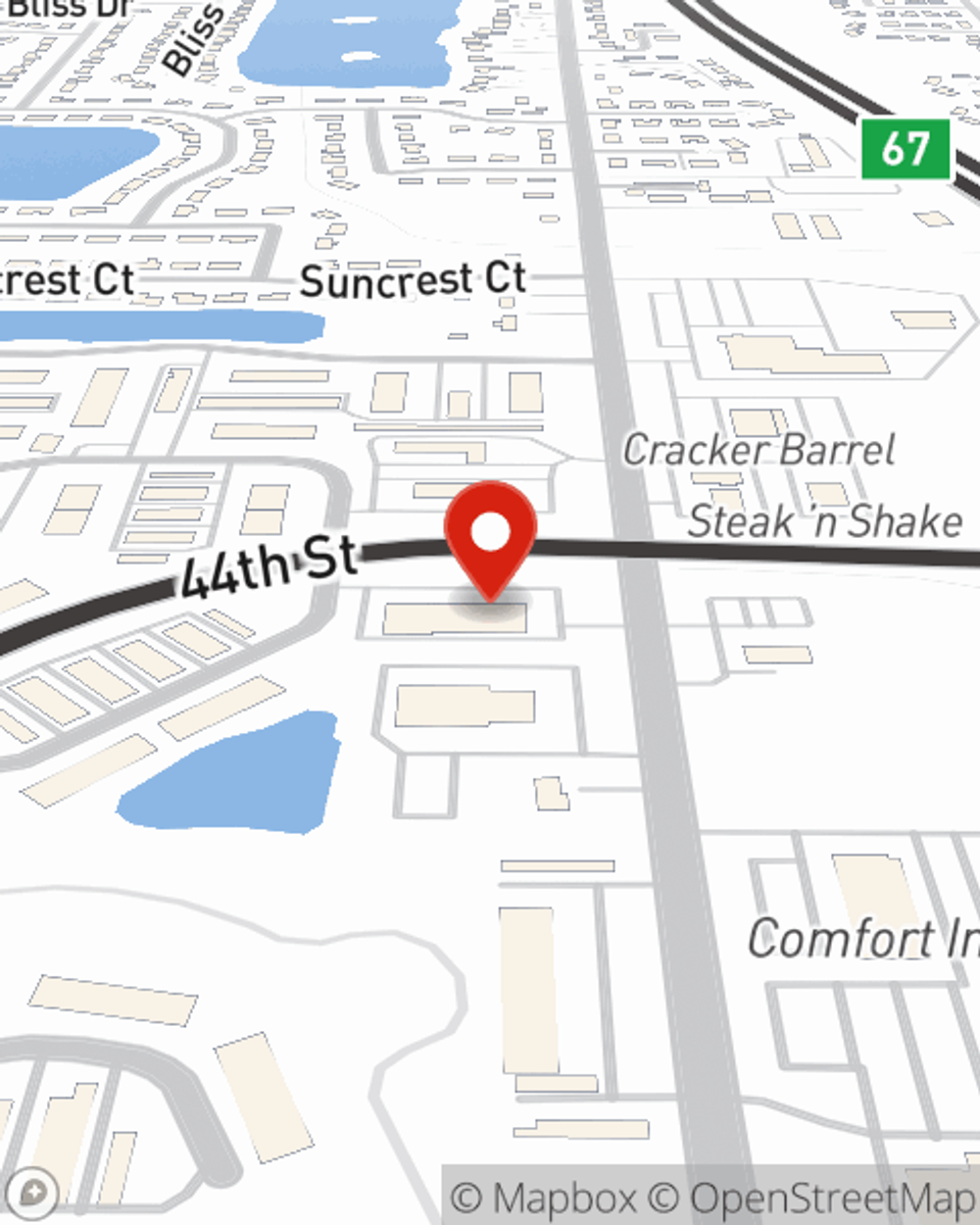

- Grandville, MI

- Wyoming, MI

- Jenison, MI

- Hudsonville, MI

- Georgetown Township

- Kentwood, MI

- Grand Rapids, MI

- Walker, MI

- Allendale, MI

- Borculo, MI

- Zeeland, MI

- Holland, MI

- Grand Haven, MI

- Spring Lake, MI

- Rockford, MI

Check Out Life Insurance Options With State Farm

When you're young and a recent college graduate, you may think you don't need Life insurance. But it's a great time to start looking into Life insurance to prepare for the unexpected.

Coverage for your loved ones' sake

Life happens. Don't wait.

Agent Jackie Weeber, At Your Service

Life can be just as unforeseeable when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers multiple coverage options. Whether you're looking for coverage for a specific number of years or level or flexible payments with coverage to last a lifetime, State Farm can help you choose the right policy for you.

As a dependable provider of life insurance in Grandville, MI, State Farm is ready to protect those you love most. Call State Farm agent Jackie Weeber today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Jackie at (616) 457-9050 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Jackie Weeber

State Farm® Insurance AgentSimple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.